- BACKED | by Improbable

- Posts

- SPOTLIGHT | Otomato, the foundation for safer, smarter automation across Web3

SPOTLIGHT | Otomato, the foundation for safer, smarter automation across Web3

How Otomato’s no-code tools and new DeFi Assistant deliver powerful, reliable automation without complexity or guesswork.

THE FOUNDER

Otomato is redefining what automation in Web3 can look like. Instead of complex scripts and opaque bots, it gives users intuitive, intelligent tools to manage DeFi positions, track opportunities and stay protected, all in real time.

Co-Founder Dylan Breugne, a serial founder with experience across product, growth, and community-led ventures in both Web2 and Web3, is leading that shift. His focus is on translating complex crypto workflows into tools that feel simple, reliable, and usable for anyone.

In this interview, Dylan dives into how Otomato makes automation both powerful and safe, what user behaviour is teaching them about the evolving DeFi landscape, and why tools that are accessible, actionable, and reliable are now critical for anyone navigating Web3.

To see Otomato in action, launch the assistant and keep track of the protocols that matter most to you here.

THE INTERVIEW

You describe Otomato as an “Automation OS” for Web3. What does that mean for everyday users, and what can it do for them that wasn’t possible before?

When we started, we noticed a big gap in Web3: the technology was powerful, but building automation, like trading bots or alerts, wasn’t accessible to most people. A lot of users wanted to launch automated strategies, but the technical barrier was too high. Otomato solves this by putting automation within reach. Its no-code builder lets users design powerful bots in just a few clicks with no coding, complex integrations, or technical expertise required. What was once limited to engineers and developers is now accessible to anyone navigating Web3.

Otomato recently raised a higher-end pre-seed round from Improbable to fuel the next evolution of the platform. How does the partnership accelerate what you can build?

The investment brings not only essential capital but also a level of expertise that materially shifts what we can achieve. It enables us to grow our marketing, engineering and product teams, speed up feature development, and strengthen the platform’s stability and scalability. It also gives us the freedom to invest in user acquisition and test new activations, which were harder to prioritise when we were fully bootstrapped.

Crucially, Improbable’s experience gives us access to best practices in infrastructure, scalability, and go-to-market strategy. Their guidance translates directly into faster iteration, sharper product decisions, and more effective distribution. It’s the kind of support that helps Otomato move from being a powerful Web3 tool to becoming a comprehensive automation ecosystem with long-term durability.

You’ve just launched the new DeFi Assistant, the next evolution of Otomato OS. What is it, what problems does it solve, and why is now the right moment for it?

To understand why we launched the DeFi Assistant, it helps to look at the journey so far. We started with Otomato OS and the no-code builder, powerful tools on their own, but after a year we realised a hard truth: even the best product can’t succeed without distribution. We had assumed great technology would naturally attract users, but in reality, amazing tech still needs a way to reach people quickly.

That’s what the DeFi Assistant is designed to do. It’s a free tool that gives users something useful from the moment they plug in their wallet. For the hyper-EVM community, Otomato OS analyses positions and surfaces what genuinely matters, including liquidation risk, missed opportunities, airdrops, emerging market signals. It tracks relevant tweets, interprets their context, and lets users automate what should happen next, whether that’s buying, selling, or simply being notified. Everything flows directly through Telegram, with human-in-the-loop approval to keep users in control.

The result is a tool that helps people monitor positions, manage risk, and respond quickly. Feedback has been extremely positive, usage is climbing every month, and the focus now is scale, turning the DeFi Assistant into a gateway that helps even more users navigate DeFi safely and efficiently.

Why is this moment the perfect time to launch a new 'Automation OS'? What does Otomato understand about the current market needs that others are missing?

The timing for launching is perfect because the market is demanding two things: tools that help users earn more or waste less time. With the DeFi Assistant, we’re addressing both. It consolidates critical information, alerts, airdrops, relevant market updates, and delivers it straight to users’ inboxes, removing the need to sift through dashboards or endless feeds. More importantly, it ties those insights to real wallet activity. Users are warned when they’re approaching liquidation, prompted when opportunities emerge, and supported with automated actions when timing genuinely matters.

Your background spans product leadership at perfumery Maison 21G and building viral, community-driven content engines with When Shift Happens. How has that shaped Otomato?

My previous ventures taught me two core lessons: how to build products that users love, and how to engineer growth strategically.

At 24, I co-founded a perfumery and served as CTO. That experience gave me a deep understanding of product development and technical growth in Web2, everything from distribution and user acquisition to analysing user behaviour. Those lessons still inform how I approach product strategy today.

Later, with my podcast When Shift Happens, my co-founder and I engineered every detail for growth. Each episode had a clear goal: who we were interviewing, why, and what outcome we wanted. That experience reinforced the importance of data-driven iteration, measurement, and strategic distribution, principles that can be applied across mediums and markets.

Web3 presents a very different landscape. Distribution is more fragmented, user acquisition is harder, and reaching the right audience in deep DeFi requires focus on channels like Twitter and Reddit. Competition is intense, and there aren’t the same acquisition levers available as in Web2. But the same principles apply: we run tests, measure user behaviour, stress-test our product, and pivot quickly. This approach allows us to optimise growth amidst the unique challenges of the Web3 ecosystem.

How does Otomato differentiate from existing automation solutions?

Otomato takes a platform approach rather than solving a single, narrow problem. Otomato OS gives users a way to build and adapt automations across many different use cases, instead of locking them into one predefined workflow. Over time, those automations can expand and connect, which makes the system more useful the longer someone uses it.

The platform is also available as an SDK, so anyone can build their own front end while relying on Otomato OS to handle the underlying logic and integrations. This separation lets teams experiment with new ideas without rebuilding core infrastructure each time. It’s this flexibility and extensibility, rather than a single feature, that sets Otomato apart from traditional automation tools.

Why focus on DeFi out of all the markets in Web3?

To me, DeFi is one of the few markets in crypto that has proven longevity and real utility. It’s here to stay. Prediction markets and stablecoins show similar signs of sustained adoption, and together these three verticals have gained meaningful traction, while many other areas are still experimental and require further validation. That’s why we chose to focus our efforts on DeFi first.

Our aim is to become a key player in DeFi while building a foundation to expand into other verticals. Prediction markets, for example, are a natural next target. They offer numerous automation opportunities and could benefit from the same alerts and tools we’re developing with the DeFi Assistant.

Your automation agents react to both onchain and offchain signals. How do you balance speed, accuracy, and privacy, and why does that matter to users?

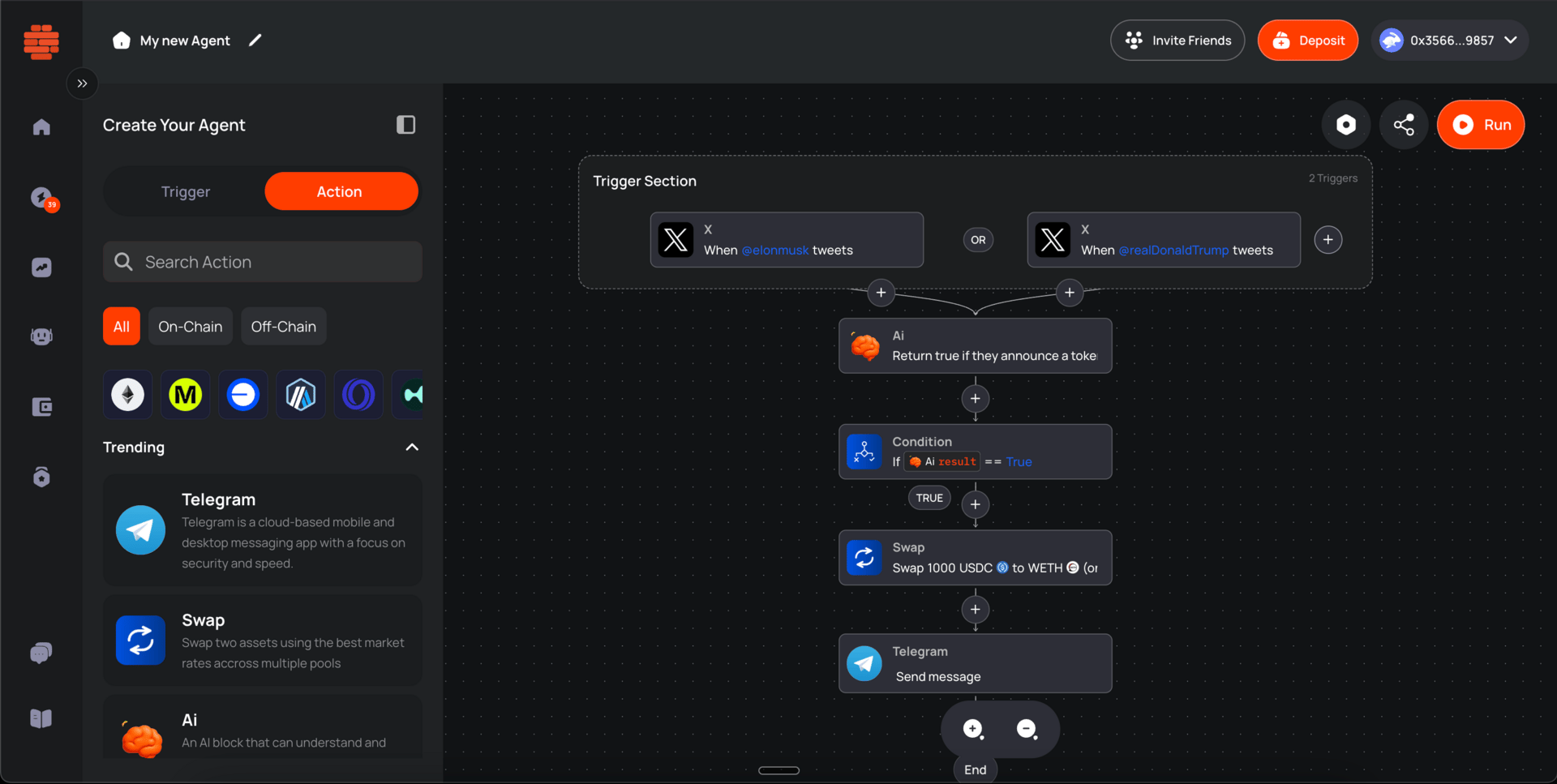

One of our most popular features is Twitter automation, which fetches and reacts to relevant signals in real time. For example, if a high-impact tweet mentions a token, the system can trigger buying actions within minutes. Market movements on platforms like X are captured instantly, while on-chain data and APIs are also monitored to provide a complete picture.

To ensure reliability, we use a double verification layer. When a Twitter signal is detected, an AI model evaluates it to verify context, say, a bullish mention of Doge, before triggering any action. A second AI then cross-checks the first assessment to minimise false positives. This layered approach maximises confidence that signals are accurate while maintaining user privacy and security. This is the most robust model we’ve designed, giving users fast, safe, and actionable automation.

If someone says, “Automation in crypto sounds risky,” how do you explain the opposite?

We get this question a lot, and I always say the same thing: Automation is just software designed to make complex tasks more accessible and manageable. Yes, it can be risky if set up poorly, but with the right safeguards, it actually reduces mistakes and protects users.

The key is how triggers are configured. For example, if a tweet is used as an input, the source must be accurate and verified. Our double automation layer to validate signals, ensuring accounts aren’t corrupted and sources are reputable.

We also introduced a human-in-the-loop step: before executing a swap or other action, the bot asks the user to approve via Telegram. Users can double- or triple-check actions through a simple poll request, giving them full control and confidence while still benefiting from automation.

Looking ahead, what does scaling Otomato look like over the next 12–18 months?

Looking ahead, the next 12–18 months are about turning the DeFi Assistant into a trusted protocol that not only alerts users but actively helps them take the right action. For example, if a user is at risk of liquidation, the DeFi Assistant could prompt or even execute a strategy, such as adding liquidity to a position, through a human-in-the-loop system. This keeps users in control while giving them confidence that the right actions are taken at the right time.

We’ve had users tell us they’d want a call in the middle of the night if their position was at risk. That level of urgency highlights the critical role of proactive, intelligent automation in managing risk.

Alongside scaling the DeFi Assistant, we’re continuing to expand the wider Otomato OS product suite with yield tools, advanced notifications, and additional automation layers. All of our tools compound into a single vision: an ecosystem that helps users navigate Web3 safely, efficiently, and with confidence, no matter how fast the market moves.

Building something ambitious?

We work with founders solving complex problems in AI transformation, the metaverse and Web3 – the kind that don’t get built alone.

That’s a wrap for this month.

We’ll be back next month with more progress and another venture in the spotlight. P.S. Have feedback, suggestions or topics you'd like us to dive into? Contact us.